The plans of Albion electrical :

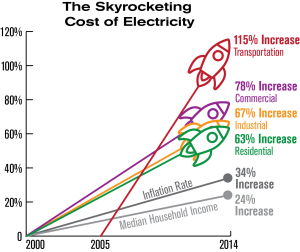

The UK government has released plans to help people fight the rising energy cost for all households in Albion Electrical . Scotland and Wales will get a 400 pound discount on their energy bills. Regardless of income or the size of the house they live in, the money will not be credited as a lump sum payment. But be dispersed in six installments with 66-pound discounts distributed from October to November this year, which will be up to 67 pounds from December to March—next year, the coldest months experienced here in the United Kingdom. How Britons will get the support deal depends on how they pay their electricity bills; those who pay by direct debit will see an automatic deduction from their final bill. Those using prepaid meters will get an automatic Top-Up which can be used for future payments.

While others will receive